Introduction

View the Executive Summary for this Brief.

Historically, America has taken care of its poor by helping them improve their circumstances, which allows them to rise out of poverty. Franklin D. Roosevelt, whose New Deal laid the foundation for today’s welfare programs with the Aid to Families with Dependent Children program in 1935, believed welfare could tear apart the American spirit. He said, “continued dependence upon relief induces a spiritual disintegration fundamentally destructive to the national fiber. To dole our relief in this way is to administer a narcotic, a subtle destroyer of the human spirit.”

Government assistance to the poor was never meant to keep people trapped in poverty, yet many of today’s programs do just that. So if current policy is not working, what needs to happen to increase opportunity and upward mobility for all?

Listen to The Civic Leader Podcast for an audio version of this brief.

Watch The Policy Circle’s Move the Needle Virtual Experience: Poverty in America, with filmmaker Christopher Rufo, from the Discovery Institute’s Center on Wealth and Poverty.

Case Study

Kimi Gray “became a national figure because of her efforts to empower residents of public housing. She was a divorced mother of five children in her early twenties, living in one of Washington, D.C.’s most notorious open-air drug markets. Chronically neglected by the D.C. Housing Authority, the residents were often without heat or hot water for weeks at a time. Kimi took on management duties for her development. Within six months, she organized and hired residents and instilled discipline and a sense of hope that revived the entire complex. Even though she was a high school dropout, she managed to send all five of her children off to college. Countless residents sought her help in sending their children to college as well.

As a consequence, Kimi created an initiative called College Here We Come that enabled 600 youths from her public housing development to attain higher education. The initiative made national news. Yet when four of the students came home on semester break, they were ashamed to bring their friends. That set Kimi on a quest to promote improvements in her complex. She was elected resident leader and galvanized the entire neighborhood in a massive restoration effort that drove out the drug dealers and promoted personal responsibility. Kimi’s approach was no-nonsense and entailed high standards. Her efforts virtually wiped out teen pregnancy and helped to make Kenilworth Parkside not only one of the safest places to live, but a place that saw a dramatic reduction in welfare dependency, as well” – Bob Woodson, The Ripon Society

See more about Kimi Gray’s life and work in this C-SPAN interview.

Why it Matters

Poverty has a human and financial price tag. Many people for whom poverty is a stark reality are less able to engage in life, liberty, and the pursuit of happiness. Studies have even indicated that poverty is a top predictor of stress and poor cognitive performance. Generational poverty plagues certain communities and creates cultural barriers to a better life.

Poverty also costs big money: as of 2019, before the COVID-19 pandemic, more than $23 trillion was spent on poverty relief programs since the 1960s, yet the overall poverty rate has barely moved. This affects the entire population, from understanding how tax dollars go to social safety net programs to accounting for the massive debt caused in part by public spending and anti-poverty programs. If these expansive efforts are making little headway, finding ways to make lasting changes in people’s lives at the local level, like Kimi Gray did, may be the key to alleviating poverty.

Putting it in Context

History

Two centuries ago, most Americans – at least 90% – were desperately poor by today’s standards. Most houses were small, ill-constructed, and poorly heated and insulated. Based on federal family income estimates, 59% of Americans lived in poverty as late as 1929, before the Great Depression. In 1947, the government reported 32% of Americans were poor.

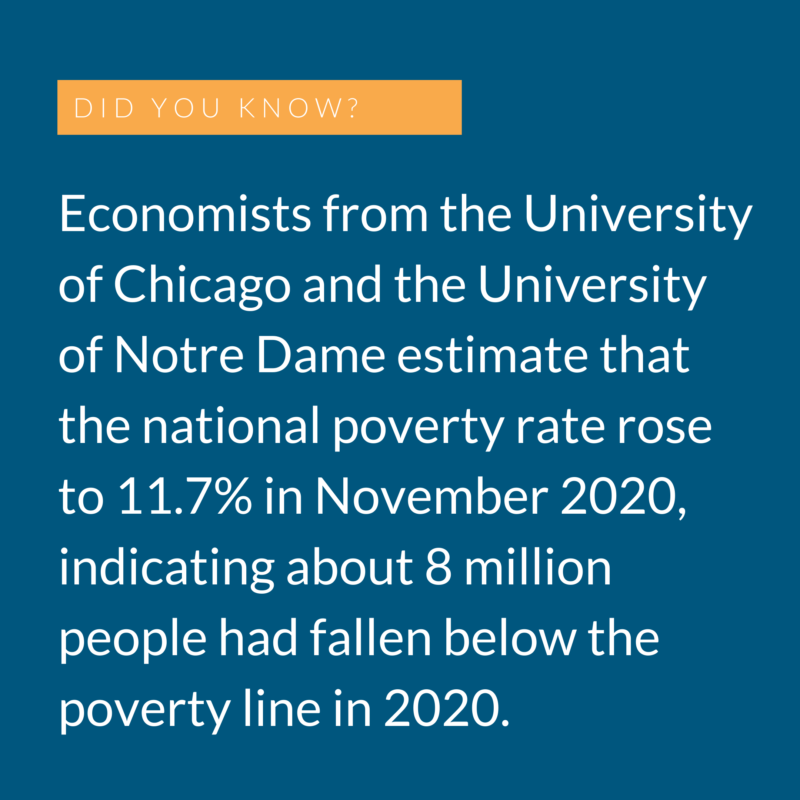

In 1965 President Lyndon Johnson declared the War on Poverty, and by 1969, poverty had declined to 12%. The percentage of poor Americans has remained near the same level, ranging from around 11% to 15% since 1973. In 2014 it was 14.8 percent, about the same rate as in 1967. In 2020, it was 11.4%, representing 37 million people.

In other words, poverty was declining in America before the huge growth in government spending on poverty programs. Despite U.S. taxpayers having spent approximately $23 trillion on over 100 anti-poverty programs since 1965, there have not been significant declines in poverty since. In 2020, the coronavirus pandemic’s economic toll only further complicated addressing poverty in America.

In other words, poverty was declining in America before the huge growth in government spending on poverty programs. Despite U.S. taxpayers having spent approximately $23 trillion on over 100 anti-poverty programs since 1965, there have not been significant declines in poverty since. In 2020, the coronavirus pandemic’s economic toll only further complicated addressing poverty in America.

By the Numbers

A 2019 analysis from Urban Institute estimated 59 million people (19% of the population) receive assistance from at least on of six major safety net programs. This results in a hefty sum: the federal government spent $847 billion on 13 welfare programs in 2020, amounting to 13% of the federal budget. In 2019, state and local governments spent an additional $288 billion on anti-poverty programs including $66 billion on welfare programs and $22 billion on Medicaid. Data from the Organization of Economic Development (OECD) show the U.S. is the second highest social spender (30% of GDP) across member countries, just behind France (32% of GDP).

Understanding Poverty

Causal Factors

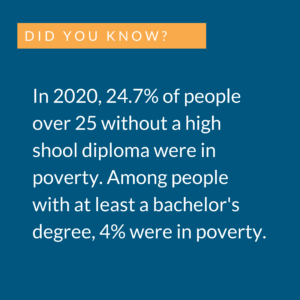

To understand how to fight poverty it helps to better understand the underlying causes. Those living in poverty are often cut off from three crucial sources of support: education, work, and family.

In their well-known “success sequence,” Brookings Institute scholars Ron Haskin and Isabel Sawhill identify three steps to joining the middle class: “At least finish high school, get a full-time job and wait until age 21 to get married and have children.” Their research shows that 2% of American adults who followed those three rules live in poverty and about 75% joined the middle class. Haskin and Sawhill acknowledge there are likely to be other influences at play, “but following [these rules] guides a young adult away from poverty and toward the middle class.”

In their well-known “success sequence,” Brookings Institute scholars Ron Haskin and Isabel Sawhill identify three steps to joining the middle class: “At least finish high school, get a full-time job and wait until age 21 to get married and have children.” Their research shows that 2% of American adults who followed those three rules live in poverty and about 75% joined the middle class. Haskin and Sawhill acknowledge there are likely to be other influences at play, “but following [these rules] guides a young adult away from poverty and toward the middle class.”

Types of Poverty

Robert Woodson of The Woodson Center has addressed poverty in toxic urban centers for 40 years. He outlines four categories of poverty and how each requires different solutions, demonstrating there is no “one-size-fits-all” solution for eradicating poverty. Woodson’s testimony on poverty before the U.S. House Committee on the Budget outlines the following categories:

- People who have experienced an unexpected setback due to circumstances out of their control, such as the loss of a job, home, spouse or other supporting family members. “Assistance to them serves as a bridge back to economic stability. They use government programs as originally intended: as an ‘ambulance service’ not as a transportation system.”

- People stuck in the poverty trap, who are trapped in a vicious cycle. They know that as they earn or save money, their benefits will be reduced or terminated. For many, even with a job, a reduction in benefits can make it difficult or nearly impossible to live. Therefore, “the disincentives for becoming independent outweigh the incentives.”

- People with disabilities and suffering mental illnesses, many of whom will always be in need of some support. The country’s aging population may fall in this category.

- People suffering from alcoholism and addictions “are poor because of the chances they take and the bad choices they make…Giving ‘no-strings’ assistance to this group enables them to continue their self-destructive lifestyles and injures with the helping hand. For this group, intervention is a necessary precondition for assistance so that they move to the ranks of Category 1, where assistance and opportunities can be a stepping stone toward self-sufficiency and upward mobility.”

These categories not only help us understand poverty, but also remind us that poverty is not just about financial resources. It is extremely complex, and each individual experiencing poverty has a unique set of circumstances. For example, the first type of poverty encapsulates situational poverty, experienced for a short period of time, while the second type relates to intergenerational poverty, defined as poverty and welfare dependency spanning multiple generations within a family. Different approaches are necessary to address the multiple facets of poverty and the different situations among individuals.

The Georgia Center for Opportunity’s Intergenerational Poverty Project, for example, calls for “deeper insights into how families understand and perceive their situation,” such as understanding the thoughts and behaviors not only of parents but also of children and teenagers in families experiencing intergenerational poverty. Dr. Ruby Payne, Founder and President of aha! Process, Inc., has created such a framework for working with students and adults from poverty so as to best create “an understanding of the dynamics that cause and maintain poverty from the individual to the systems level.” The approach, originally written for teachers but available to anyone, addresses various teaching methods and cognitive strategies, as well as the importance of emotional resources, support systems, and role models.

The Role of Government

Historically, government has played a central role in alleviating poverty, particularly since the New Deal and The War on Poverty were implemented. Arthur Brooks of the American Enterprise Institute notes that most people “believe the government has a moral obligation to help those who, through bad luck or unfortunate circumstances, can’t help themselves.” What government’s actions should be is where there tends to be more disagreement. Arthur Brooks explains more (4 min):

Some favor an approach that emphasizes improving the immediate material living conditions of people in poverty and reducing income differences. Success in the War on Poverty is viewed in terms of how many people are receiving the help they need and of programs that equalize income to reduce poverty, including:

- Increasing the minimum wage

- Extending long-term unemployment benefits

- Spending more money on current and new poverty programs

- Imposing higher tax rates on high earners to fund additional Safety Net programs

Others believe policies must encourage people in poverty to seek work to improve their lives and incentivize economic growth and job opportunities. According to Michael Tanner of the Cato Institute, the policy focus should be “less on making poverty comfortable, and more on creating the prosperity that will get people out of poverty.”

People need work opportunities where they can experience “earned success,” as noted by Arthur Brooks. Work is an opportunity for everyone to add value, including those with physical and intellectual disabilities. Through work, people feel needed and valued, become part of a community and learn responsibility. Children can also see the value and reward of hard work to better their lives and help break the generational cycle of poverty. According to 2020 Census Bureau Income and Poverty data, the poverty rate for all workers increased from 4.7% in 2019 to 5% in 2020, and the poverty rate for those who did not work for at least one week during the year increased from 26.4% in 2019 to 34.7% in 2020 (note that layoffs from the coronavirus pandemic also affected this statistic).

Analysis and Accountability

Another step in making government work better for people is analyzing whether or not programs are actually effective by tracking metrics and providing accountability of funds. This is the goal of the Evidence-Based Policymaking Commission Act passed by the House and Senate signed by President Obama in 2016. The Act established the Commission on Evidence-Based Policymaking (CEP), which focuses on properly using data to improve how government programs operate. The federal government is in a position to supervise by setting benchmarks, publishing results, and ensuring that states are not misusing taxpayer funds. The role of federal government should be coordinated, targeted, evidence-based, and in line with the 10th amendment of The United States Constitution; that is, the federal government is to act as a referee, not a player.

The Safety Net

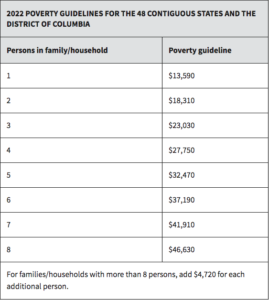

According to Federal Safety Net, The Social Safety Net (Safety Net) of the United States is made up of various welfare programs that protect low-income Americans from poverty and hardship. The theory is that by catching Americans if they fall on hard times, Americans of sound body and mind can get back on their feet. For those individuals without sound body and mind, the Safety Net protects them with a minimum standard of living. Federal poverty level guidelines, based on Census data of the number of Americans in poverty, establish financial eligibility for these programs.

The Social Safety Net includes both contributory and non–contributory programs. For contributory programs such as Social Security and Medicaid, Americans pay into the programs during their working years and receive benefits later in life. Other programs are “non-contributory transfer payment programs,” meaning low-income Americans don’t have to contribute into the programs to receive benefits.

Thirteen categories of welfare programs are shown on the Safety Net Programs Page. State programs and non-profit organizations also make up the Social Safety Net available to Americans. These programs vary by location and typically include food, housing, counseling and other benefits. Some of the more commonly known programs are:

- Medicaid, a joint federal-state program designed to provide health coverage to low-income families, single mothers, and disabled individuals.

- Earned Income Tax Credit (EITC), which provides cash assistance to low-income working families, it was designed to offset Social Security taxes and to do so in a way that encouraged work.

- Temporary Assistance for Needy Families (TANF), which replaced the New Deal-era Aid to Families with Dependent Children (AFDC). It offers fixed annual grants to states, gives states much flexibility in designing their own programs with the grants, and institutes work requirements and time limits on aid.

- The Supplemental Nutrition Assistance Program (SNAP), also known as “food stamps.” SNAP helps low-income families buy food so they can maintain a healthy diet.

- Housing Assistance that comes in the form of HUD programs such as section 8 vouchers. Families seeking housing assistance may apply through a Public Housing Authority for more than one kind of assistance, and they can accept assistance through various programs based on their eligibility.

Current Challenges and Areas for Reform

Measuring Poverty

Currently, poverty in the U.S. is measured according to thresholds that represent the minimum amount of cash income required to support households. Known as the Official Poverty Measure (OPM), this does not include benefits not in the form of cash, such as public housing and food stamps. In 2011, the Census Bureau introduced the Supplemental Poverty Measure (SPM), which defines the needs and income of households more broadly by accounting for benefits other than cash and considering average expenditures on food, clothing, housing, and utilities as well as geographic adjustments for housing costs. How poverty is measured makes a great deal of difference; in 2020, the official poverty measure was 11.4%, while the supplemental poverty measure was 9.1%. According to the Census Bureau, coronavirus stimulus payments moved 11.7 million people out of poverty and expanded unemployment benefits kept 5.5 million people out of poverty.

Anti-Poverty Programs

Anti-poverty programs suffer from duplication and overlap across agencies which cause inefficiencies and waste. Take a look at the “labyrinthine nature of the welfare system” illustrated in the chart below.

For example:

- There are 32 federal housing programs run by five different cabinet departments.

- There are 9 different healthcare insurance and assistance programs, administered by the Office of Personnel Management, the Department of Defense, and five agencies within the Department of Health and Human Services.

- In 2019, the federal government spent $63.5 billion on SNAP. The amount of SNAP benefits paid in error in 2019 increased to 7.3%, up from 6.8% in 2018 and 6.3% in 2017.

- In 2019, the Department of Labor improperly paid $2.85 billion in Unemployment Insurance and the Social Security Administration improperly paid $5.65 billion in Supplemental Security Income (SSI).

We are spending extraordinary amounts of taxpayer money on fighting poverty yet the poverty rate remains roughly the same. Streamlining these programs to avoid duplications and overlap may add some relief to the overburdened and costly system. Particularly for programs that overlap, program staff often spend time on duplicative work. A USDA report even noted that Food and Nutrition Services “could potentially achieve cost savings by taking actions to eliminate duplication and overlap” in its 15 different food assistance programs. Unnecessary steps add to administrative and operating costs, and can lead to mistakes that increase both overpayments and underpayments.

A different solution could focus on where federal dollars are invested. Based on a study done by Civic Enterprises, an annual federal investment of $6.4 billion a year in proven existing federal programs – like AmeriCorps, Back on Track Schools, Public Allies, Service and Conservation Corps, or YouthBuild programs – would reconnect one million young adults every year. Each reconnection to education and/or employment could directly save taxpayers $236,000 and will save a total social cost of $704,000. Thus, if these programs succeed with just half of their participants, the lifetime direct return on investment to taxpayers would be over $118 billion for each year of investment.

The Poverty Trap

People fall into the “poverty trap” or “welfare trap” when what they earn at a job is not much more than what they can get from the government by not working, which functions as a disincentive to work more. Michael Tanner of The CATO Institute explains the poverty trap (5 min):

Dozens of different welfare programs “often impose high effective marginal tax rates that make it harder for low-income people to transition out of these programs and into the middle class.” These tax rates can discourage work. A marginal tax rate “is the percentage of an additional dollar of earnings that is unavailable to an individual because it is paid in taxes or offset by reduced benefits from government programs.” For example, the marginal tax rate for households with children with incomes below 200% of the poverty line was between 20% and 59% in 2019. This means that for each additional dollar of income a family in this range earns, the family would lose anywhere from 20 cents to 59 cents to taxes or lost benefits. This was the highest marginal tax rate of any income level, showing that “[a]s earned income rises, declines in unearned income offset large portions of the gain.”

Dozens of different welfare programs “often impose high effective marginal tax rates that make it harder for low-income people to transition out of these programs and into the middle class.” These tax rates can discourage work. A marginal tax rate “is the percentage of an additional dollar of earnings that is unavailable to an individual because it is paid in taxes or offset by reduced benefits from government programs.” For example, the marginal tax rate for households with children with incomes below 200% of the poverty line was between 20% and 59% in 2019. This means that for each additional dollar of income a family in this range earns, the family would lose anywhere from 20 cents to 59 cents to taxes or lost benefits. This was the highest marginal tax rate of any income level, showing that “[a]s earned income rises, declines in unearned income offset large portions of the gain.”

Antony Davies from Mercatus explains how this marginal tax rate works:

The Local Approach

Often, programs to eradicate poverty are designed by those unfamiliar with local conditions better understood by local leaders who have the knowledge and credibility necessary to implement change. Designing programs at the local level allows the assistance to be tailored to fit the needs of those in poverty. For example, the private, community-based organization The Woodson Center provides effective community and faith-based organizations with training and technical assistance, links them to sources of support, and evaluates their experiences for public policy.

The Woodson Center provides training to more than 2,600 leaders of community organizations in 39 states and helps community residents deal with issues such as youth violence, substance abuse, teen pregnancy, homelessness, joblessness, family dissolution, poor education, and deteriorating neighborhoods. For example, one Milwaukee-based program under the umbrella of The Woodson Center, the Violence-Free Zone (VFZ) initiative, is reducing violence and disruptions in 12 Milwaukee public schools and is preparing students in the most disadvantaged communities to learn and to succeed.

In his column for The Ripon Society, Robert Woodson of The Woodson Center writes, “History clearly demonstrates that achievements against the scourge of poverty must originate among those experiencing problems. It begins with a belief that self-development is possible, and no matter what their circumstance, they have the capacity to be agents of their own uplift.”

Woodson knows “there is no magic policy lever we can pull to eradicate poverty. However, there are effective community-based models that are successfully solving some of our nation’s most intractable problems.” Empowering the states and communities on the front lines can truly break down barriers to opportunity and make the Safety Net more effective.

This is also what Christopher Rufo, filmmaker and director of the Discovery Institute’s Center on Wealth and Poverty, found while creating his documentary, America Lost. The film explores economic hardship and distressed communities in the American interior, focusing on three “forgotten American cities.” By examining the effects of top-down public policies and listening to the personal stories of community members, the documentary illustrates poverty as not only an economic dilemma but a social and cultural one as well. Civil society plays a crucial role; like Woodson, Rufo found that “real change doesn’t happen from the top-down. It happens from the inside out. It starts with each individual heart and slowly works its way outward to families, neighbors, and communities.”

Indirect Measurements of Poverty: Wealth and Income

Poverty is an indirect measurement of assets, debts, and income. The value of assets (such as houses, savings and stocks) minus debts (such as mortgages and credit card balances) is referred to as wealth. Between 1998 and 2016, the U.S. economy roughly doubled, meaning everyone got wealthier. In recent years, however, debt has become a burden for many Americans. In 2022, total U.S. household debt hit is over $15 trillion.

In 2019, the bottom half of all U.S. households had just begun to regain the wealth lost in the financial crisis and had about ⅓ less wealth than they did in 2003. The top 1% of households had twice as much wealth as they did in 2003. Much of this disparity came from differences in assets: more than 85% of the assets of the top 1% are in stocks or bonds, and just over half of assets owned by the bottom 50% of households is in the form of real estate. While a strong stock market can increase financial assets, home prices have outpaced incomes since 2009 which makes it harder to purchase a home and leaves many households without a real estate asset (WSJ).

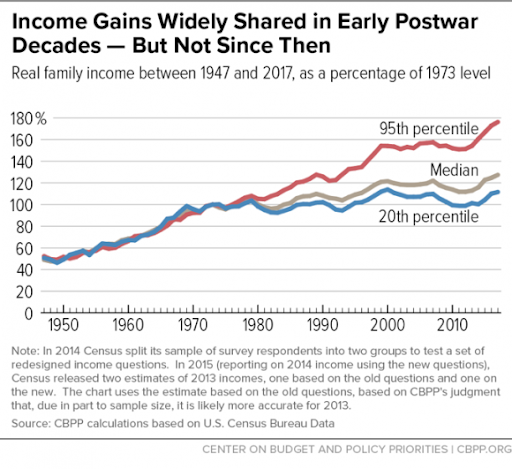

Income refers to “cash received during a year from working, dividends, interest, rents, and government programs.” After WWII, incomes across the distribution grew at about the same rate, until the 1970s when disparities began. How large these disparities actually are is not set in stone, and depends on which measurements economists use when studying income.

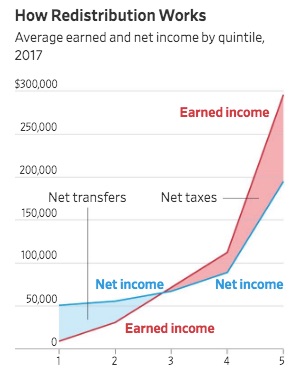

In 2017, the Census Bureau published data saying the top 20% of households had 17 times as much income as the bottom 20% of households. When looking at the amount earned in a paycheck, this may be accurate, but when looking at total disposable income, the results are extremely different. The Census Bureau measurement was taken before taxes and transfers, ignoring the 80% of all taxes paid by the top 40% of households and the 70% of all public transfer payments that go to the bottom 40% of households (WSJ).

Studies focusing on income inequality can find markedly different results depending whether they account for taxes and transfers: examining income inequality between 1979 and 2014, Piketty, Saez, and Zucman (2018) find the wealthiest 10% received 55% of income growth; CBO (2018) finds the top 10% received 46% of growth; and Auten and Splinter (2018) report the top 10% percent received 31% of income growth.

Where studies have shown similar trends is in examining incomes since the Great Recession. Young people were hit especially hard by the recession, and the slow recovery has meant lifetime earnings are measurably lower for Millennials. A 2019 Deloitte study found the average net worth of Millennials (ages 18 to 35) is less than $8000. But things may be looking up – in 2019, U.S. workers under 35 reported being happier with their paychecks than people over age 55 for the first time since 2011. Median weekly earnings rose 5% from the end of 2017 to the end of 2018.

The middle class was also demoralized throughout the recession and recovery. Longer working hours combined with increasing costs of education, healthcare, and housing have caused many to fear that they could fall out of the middle class altogether. When Baby Boomers were in their 20s, 70% were in the middle class; today for Millennials, that number is just 60%. In fact, in terms of net income, the average middle class household earns 13 times more than the average household in the bottom 20% and works more than twice as many hours a week, but still somehow only has 32% more net income.

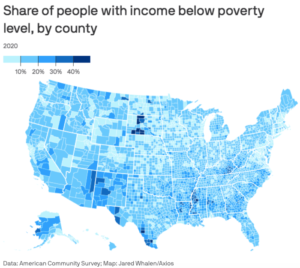

According to the Economic Research Service, average per capita income for all Americans in 2020 was $59,510, while average per capita income in rural areas was $45,917. Figures from the Institute for Research on Poverty show this is nothing new: monthly poverty rates for rural areas are almost 4% higher than annual poverty rates reported by the Census Bureau. From 2015-2019, poverty in metro areas (urban) was on average 6% higher than in nonmetro areas (rural).

Universal Basic Income

Universal Basic Income (UBI) is a highly controversial concept defined as a “guaranteed cash benefit that the government provides to all citizens,” and has garnered renewed attention as a method of streamlining “the current complicated and sometimes counterproductive system of U.S. transfer programs.” Critics maintain UBI is “not ideal for redistributive purposes” and pursuing a “pro-work, pro-skills agenda” that invests in human capital would do more than a simple hand-out to “advance both individual economic security and aggregate productivity.”

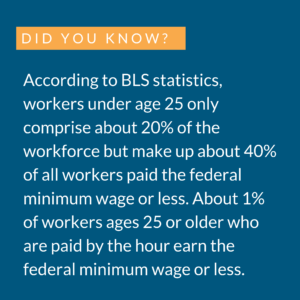

$15 Minimum Wage

Another heated debate in terms of poverty and income is the movement for a $15 minimum wage. Proponents argue the current minimum of $7.25 is not a livable wage, and a Congressional Budget Office analysis found that raising the minimum wage to $15 by 2025 would increase paychecks for 27 million workers and pull almost 1 million Americans out of poverty. A number of large companies including Costco, Target, and Amazon have raised their minimum wages to $15 or indicated they will do so in the coming years.

Those against the hike point to the same study, which also found another 1.4 million Americans could be forced out of their jobs. Skeptical economists note labor conditions and costs of living vary across the country, and “a one-size-fits-all policy that more than doubles some businesses’ wage bills” could force lay-offs or even business closures. Some research also shows higher minimum wages lead employers to reduce other benefits for employees and shift towards automation. In Seattle, wages rose 3% but hours decreased by 6-7%. Overall, the amount of money paid out in the low wage labor market actually declined due to reductions in hours.

Those against the hike point to the same study, which also found another 1.4 million Americans could be forced out of their jobs. Skeptical economists note labor conditions and costs of living vary across the country, and “a one-size-fits-all policy that more than doubles some businesses’ wage bills” could force lay-offs or even business closures. Some research also shows higher minimum wages lead employers to reduce other benefits for employees and shift towards automation. In Seattle, wages rose 3% but hours decreased by 6-7%. Overall, the amount of money paid out in the low wage labor market actually declined due to reductions in hours.

See which states have passed minimum wage laws at the National Conference of State Legislatures here.

Innovative Solutions

Wage supplements: The Poverty Reduction Opportunity Wage is an idea for wage supplementation that aims to “configure a wage subsidy so that if a person works full time they will not be in poverty…If a person (or couple) works full time for the year, the labor earnings are guaranteed to exceed the federal poverty line.”

Housing: Shelters to Shutters assists the homeless, veterans, and domestic violence victims. Individuals interview for entry level property management positions which offer discounted on-site housing.

Temporary support for families in crisis: Safe Families operates in 70 cities in the United States, United Kingdom, Canada, and other countries, to provide temporary support for families in crisis due to unemployment, homelessness and other challenges. Their goal is to keep children safe and out of the foster care system, and ensure they are able to reunite with their families after the crisis has passed. Safe Families matches children with volunteer host families and provides coaching and other resources.

Reducing recidivism: Those re-entering society from prison often face poverty and the challenges that accompany it. According to The CATO Institute’s Michael D. Tanner, “large numbers of people in poverty are burdened with a criminal record that makes it far more difficult for them to find jobs.”

- The Dannon Project is a community-based program in Birmingham, AL, that helps people struggling with re-entry to society, especially non-violent offenders from prison. Only 3% of the programs participants return to prison, compared with a state average of 44% percent.

- Hope for Prisoners is a Las Vegas-based training program for ex-offenders funded in part by The Woodson Center. Program support includes mentoring and skills training to prepare for employment. According to this University of Nevada Las Vegas study of 522 graduates of the program, 64% found stable employment. Of those employed, 25% found employment within 17 days of the training course. Its recidivism rate is also very low at only 6.3%.

Encouraging entrepreneurship: As outlined in the The Policy Circle’s Economic Growth Brief, business and entrepreneurship represent the largest and most successful anti-poverty program in human history. It is essential to re-open avenues for entrepreneurship as a component of fighting poverty.

- Opportunity Zones is a program created in the 2017 Tax Reform. The governors of each state select a limited amount of census tracts that meet the eligibility criteria of distressed communities to receive favorable tax treatment in the form of delayed or forgiven capital gains tax, depending on the length of the investment. The goal is to drive capital and opportunity into communities that lack such investment. Expanding access to capital can address poverty by providing new business opportunities; by one estimate, a 1% increase in the rate of new business equates to a 2% decline in poverty rate.

Conclusion

As the above examples show, poverty is a multifaceted issue that does not lend itself to a “one-size-fits-all” solution. While the complexity means there is no one solution to poverty, that same complexity provides an opportunity to address poverty from different angles, particularly at the local level. As Kimi Gray demonstrated, a dedicated community can be transformational. Unlike top-down solutions, bottom-up solutions rely on first-hand knowledge and nuanced ideas dependent on local needs. Individual communities all thriving together creates a stronger, more flourishing society overall.

As the above examples show, poverty is a multifaceted issue that does not lend itself to a “one-size-fits-all” solution. While the complexity means there is no one solution to poverty, that same complexity provides an opportunity to address poverty from different angles, particularly at the local level. As Kimi Gray demonstrated, a dedicated community can be transformational. Unlike top-down solutions, bottom-up solutions rely on first-hand knowledge and nuanced ideas dependent on local needs. Individual communities all thriving together creates a stronger, more flourishing society overall.

Ways to Get Involved/What You Can Do

Measure: Find out what your state and district are doing about poverty.

- Do you know how prevalent poverty is in your community or state?

- What are your state’s laws regarding anti-poverty policies?

- How much does your state spend on anti-poverty programs?

- Is there a coalition or task force to address poverty, or does one need to be formed?

Identify: Who are the influencers in your state, county, or community? Learn about their priorities and consider how to contact them, including elected officials, attorneys general, law enforcement, boards of education, city councils, journalists, media outlets, community organizations, and local businesses.

- Who are the members of boards or committees in your state?

- What steps have your state’s/community’s elected/appointed official taken?

Reach out: You are a catalyst. Finding a common cause is a great opportunity to develop relationships with people who may be outside of your immediate network. All it takes is a small team of two or three people to set a path for real improvement. The Policy Circle is your platform to convene with experts you want to hear from.

- Find allies in your community or in nearby towns and elsewhere in the state.

- Foster collaborative relationships with law enforcement, first responders, faith-based organizations, local hospitals, community organizations, school boards, and local businesses.

Plan: Set some milestones based on your state’s legislative calendar.

- Don’t hesitate to contact The Policy Circle team, [email protected], for connections to the broader network, advice, insights on how to build rapport with policy makers and establish yourself as a civic leader.

Execute: Give it your best shot. You can:

- Take opportunities when related articles (on economic decline, inequality, lack of access to loans for entrepreneurs etc.) appear in your local paper to write a letter to the editor and share with friends and colleagues.

- Volunteer with a local community organization, such as a food bank or an after-school program, or highlight a success story in your local paper.

- Consider donating items to local organizations, if the other alternative is throwing things out.

- Learn from local businesses, employers, and employees how raising minimum wages would affect their finances.

- Ask what the state of job creation and employment applications are.

- Find out where opportunity zones are in your state.

- Hold your elected officials accountable for what tax dollars are being spent on, and whether this spending is producing acceptable outcomes.

- Research the committees on which your Senators and Representatives serve. Search the Committee websites to investigate your representatives’ level of engagement on efforts to address poverty and welfare reform.

Working with others, you may create something great for your community. Here are some tools to learn how to contact your representatives and write an op-ed.

Thought Leaders and Additional Resources

Thought Leaders

- Robert Doar, American Enterprise Institute

- Bob Woodson, The Woodson Center

- Ron Haskins, Brookings Institution

- Scott Winship, Manhattan Institute

- Michael Strain, American Enterprise Institute

- Michael D. Tanner, Cato Institute

Additional Resources

- Extreme Poverty Around the World

- Re-imagining America’s safety net – AEI Podcast featuring Clarence H. Carter, Director of the Office of Family Assistance and Acting Director of the Office of Community Services at the Department of Health and Human Services.

- State by State poverty statistics map from Spotlight on Poverty

- Quick facts on Safety Net Programs and Welfare Reform, from Federal Safety Net

- Arthur Brooks’ Ted Talk calling for innovative solutions and working together to lift more people out of poverty.

- AEI Resident Fellow Gerard Robinson, “Help Ex-Inmates Lead Productive Lives” and “Prisoner Reentry and Why We Should Care” video (1:18).

- Wilson Shaheen Lab for Economic Opportunities

- AEI/Brookings Bipartisan Poverty Report 2015

Suggestions for your Next Conversation

Explore the Series

This brief is part of a series of recommended conversations designed for circle's wishing to pursue a specific focus for the year. Each series recommends "5" briefs to provide a year of conversations.

State Briefs

Want to learn more about how states are dealing with this issue? Read our state-specific briefs below: